Are you moving to a new home and looking to make the wise move by getting the best home insurance companies in South Africa to protect your new home and all your belongings that come with it? Well, you’ve come to the right place!

Your home is more than just a building — it's your sanctuary, a place of refuge where memories are made and cherished. But in South Africa's dynamic landscape, safeguarding your haven requires more than just sturdy walls and a secure lock. That's where home insurance comes in. Home insurance offers peace of mind, protecting your most valuable asset against unforeseen hazards like fire, theft and natural disasters.

To help you find the right cover for you, let’s check out the top home insurance companies in South Africa, each offering unique benefits and tailored solutions to meet your needs.

1. OUTsurance

OUTsurance stands tall as a pioneer in the South African insurance industry, renowned for its innovative approach and exceptional customer service. With fixed premiums providing stability and predictability, OUTsurance offers comprehensive cover against a wide range of hazards, including fire, theft and natural disasters. Their OUTbonus rewards program further encourages responsible behaviour where everyone wins.

OUTsurance stands tall as a pioneer in the South African insurance industry, renowned for its innovative approach and exceptional customer service. With fixed premiums providing stability and predictability, OUTsurance offers comprehensive cover against a wide range of hazards, including fire, theft and natural disasters. Their OUTbonus rewards program further encourages responsible behaviour where everyone wins.

For homeowners, OUTsurance offers:

-

Buildings insurance: Protect the structure and fixtures of your home with 24/7 home assistance.

-

Contents insurance: Cover all the valuables in your home against damage and theft.

-

Portable possessions: Cover everything you take out of the house against loss or damage.

2. Momentum

Momentum's commitment to providing comprehensive and affordable insurance solutions makes it a top choice for South African homeowners. Momentum offers car insurance and home insurance in one, killing two birds with one stone. This flexible cover provides up to 30% yearly cash back and safety features like Safety Alert’s panic button and 24/7 roadside, home and legal assistance.

Momentum's commitment to providing comprehensive and affordable insurance solutions makes it a top choice for South African homeowners. Momentum offers car insurance and home insurance in one, killing two birds with one stone. This flexible cover provides up to 30% yearly cash back and safety features like Safety Alert’s panic button and 24/7 roadside, home and legal assistance.

All you have to do is choose the plan that works best for you, your home and your budget. Momentum offers a range of insurance cover options, but the main two include:

-

Momentum Select: Affordable, convenient and reliable car, buildings, home contents and portable possessions cover.

-

Momentum Priceless: Comprehensive car, home contents and homeowners' insurance cover tailored to your individual needs.

3. Sanlam

Sanlam, with its century-old legacy, stands as a beacon of trust in the South African insurance industry. Sanlam’s short-term insurance options offer house contents insurance and building insurance, with the addition of vehicle insurance and all-risk insurance which if all joined together can save you a ton.

Sanlam, with its century-old legacy, stands as a beacon of trust in the South African insurance industry. Sanlam’s short-term insurance options offer house contents insurance and building insurance, with the addition of vehicle insurance and all-risk insurance which if all joined together can save you a ton.

With the help of one of their financial advisors, you can get a complete assessment of your assets and valuables to ensure that your financial plan includes protection against any adversity that could impact your lifestyle and the financial well-being of your family.

4. ABSA

ABSA's commitment to customer satisfaction and value-added services makes it a prominent player in the home insurance market. Their user-friendly digital platforms simplify policy management and claims processing, ensuring convenience for customers.

ABSA's commitment to customer satisfaction and value-added services makes it a prominent player in the home insurance market. Their user-friendly digital platforms simplify policy management and claims processing, ensuring convenience for customers.

If you’re looking for flexible and comprehensive building insurance, ABSA offers 3 plans depending on what you’re looking for:

-

Activate: Save time, money and keep your home insured with digital insurance, easily log claims on the Activate App and get up to 40% cash back with Rewards every month.

-

idirect: includes a personalised call centre experience with fixed excess from just R500, geyser claims assistance, coverage of lightning, fire, power surges and vandalism and 24/7 emergency assistance.

-

Homeowners Comprehensive (HOC): limited power surge at no extra cost, 24/7 home assistance for locksmiths, plumbing and electrical emergencies, alternative accommodation/loss of rent when your property becomes uninhabitable, unlimited geyser claims and more.

Additionally, more of ABSA’s short-term insurance cover options include:

-

Home loan insurance: Includes benefits from various Absa Life products to cover your home loan repayments if you die, are disabled, or are diagnosed with a terminal illness.

-

Portable possessions insurance: The items that you carry with you when you leave your home can be insured individually to cover you against accidental damage, loss and theft.

5. Naked Insurance

Naked Insurance upgrades the traditional insurance model with its innovative approach and customer-centric policies. By eliminating unnecessary fees and commissions, Naked Insurance offers transparent and affordable home insurance solutions. Their flexible cover options and seamless online experience make them a preferred choice for modern homeowners.

Naked Insurance upgrades the traditional insurance model with its innovative approach and customer-centric policies. By eliminating unnecessary fees and commissions, Naked Insurance offers transparent and affordable home insurance solutions. Their flexible cover options and seamless online experience make them a preferred choice for modern homeowners.

Let’s check out Naked’s various insurance options for homeowners:

-

Home contents insurance: Thefts, accidents, burst geysers, fires, floods or whatever else nature throws at you are covered by our home contents insurance, plus 24/7 emergency assistance, locks and key replacements and extra security after a claim.

-

Building insurance: Cover for your house, including fixtures like pools, fences, gate motors or jungle gyms, as well as the fixing of any water damage caused by your geyser, tanks or pipes breaking.

-

Single items insurance: Insure your valuables against theft, accidental damage or loss, whether at home or out and about.

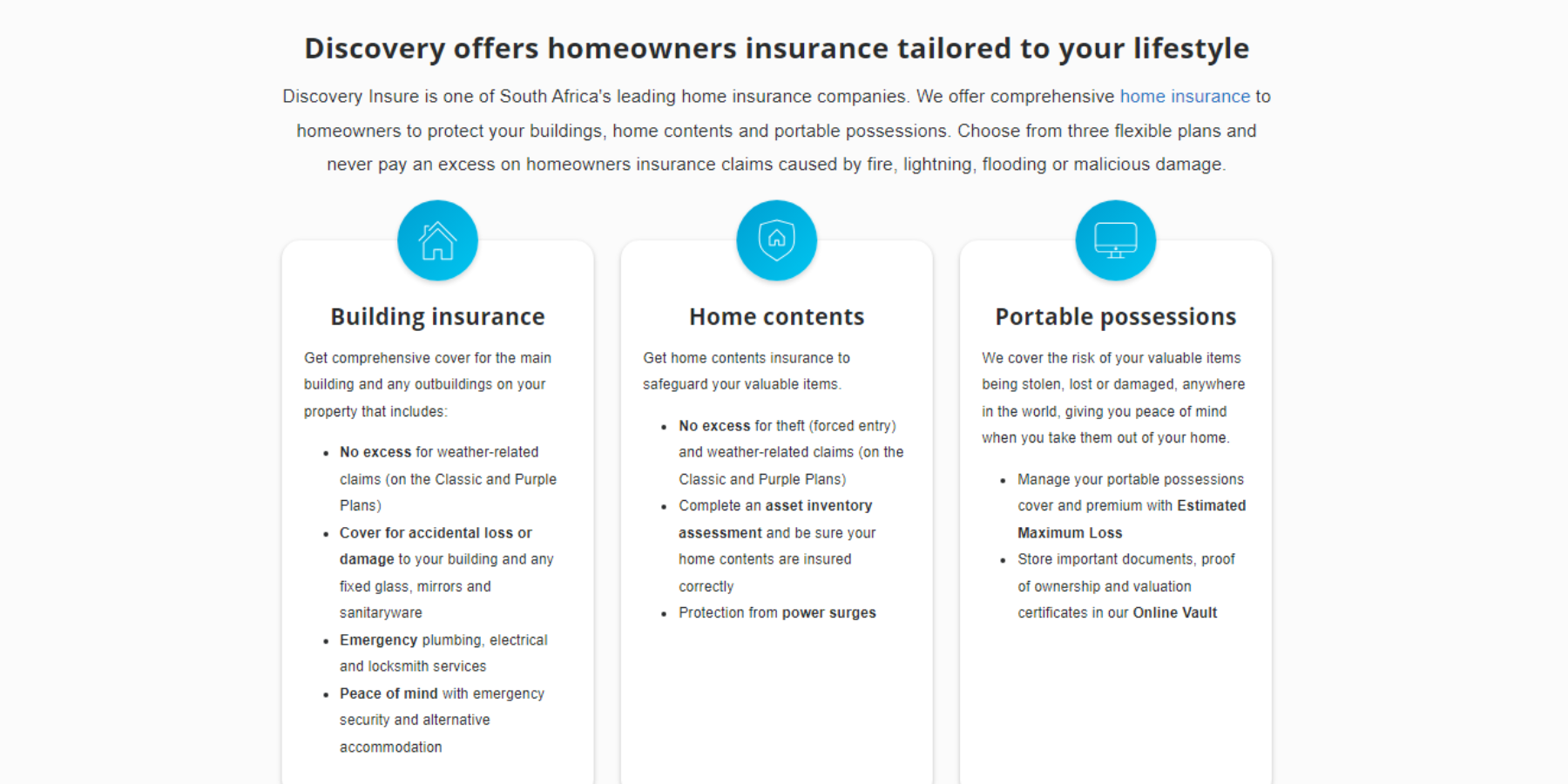

6. Discovery Insurance

Discovery Insurance's pioneering approach to insurance sets it apart in the South African market. Leveraging data and technology, Discovery promotes proactive risk management through its Vitality program. By rewarding policyholders for adopting healthy and safety-conscious behaviours, Discovery encourages a culture of prevention while providing comprehensive home insurance coverage.

Discovery Insurance's pioneering approach to insurance sets it apart in the South African market. Leveraging data and technology, Discovery promotes proactive risk management through its Vitality program. By rewarding policyholders for adopting healthy and safety-conscious behaviours, Discovery encourages a culture of prevention while providing comprehensive home insurance coverage.

Here are the homeowner's insurance options Discovery has to offer:

-

Building insurance: Covers the main building and any outbuildings on your insured property.

-

Household contents cover: Covers everything you have in your home, from appliances and furniture to clothing and pots at affordable rates tailored to your needs.

-

Portable possessions insurance: Covers your daily essentials and leisure items whenever you leave your home, including clothing, camera and media devices, computing equipment, mobile devices, jewellery and watches and more.

7. MiWay Insurance

MiWay's flexible cover options cater to the evolving needs of homeowners, offering protection against structural damage, loss of valuables and liability. With competitive premiums and user-friendly digital platforms, MiWay ensures a seamless insurance experience for its customers.

MiWay's flexible cover options cater to the evolving needs of homeowners, offering protection against structural damage, loss of valuables and liability. With competitive premiums and user-friendly digital platforms, MiWay ensures a seamless insurance experience for its customers.

MiWay’s Home Contents Insurance, also known as MiHomeStuff, insures your household belongings against fire, theft, water, wind and storm damage, plus free household emergency assistance and alternative accommodation should your building be unfit to live in following an incident.

This includes all your personal possessions inside your home belonging to you and the members of your household, such as TVs, furniture, clothing, curtains, loose carpets etc.

Additionally, MiWay offers MiPlace, a Building Insurance which covers the permanent structures on your property as well as all permanent fixtures, fittings and improvements to your property, including your borehole and swimming pool pumps as well as underground pipes and cables forming part of your building.

8. Old Mutual

Old Mutual, with its rich heritage and experience spanning over 180 years, remains a trusted name in the South African insurance industry. Their home insurance policies provide comprehensive cover against fire, theft, natural disasters and more.

Old Mutual, with its rich heritage and experience spanning over 180 years, remains a trusted name in the South African insurance industry. Their home insurance policies provide comprehensive cover against fire, theft, natural disasters and more.

To give homeowners the best of both worlds, Old Mutual offers a car and home insurance called allsure which covers your home, car, personal liability and all risks insurance needs under one comprehensive policy so you don’t have to juggle multiple insurance policies.

Within allsure, your home insurance includes:

-

Cover all your belongings, such as electronics, appliances, furniture and even the food in your freezer.

-

Swiftcare emergency roadside, home and medical assistance available 24/7

-

Coverage of fire, explosions, natural disasters such as lightning, hailstorms, fallen trees, animals and more.

You can also get Household Contents Cover with allsure which protects the contents of your private home, outbuildings and even motorcycles, caravans, trailers and boats against the unexpected, including fire, explosions, acts of nature, theft and subsidence, with legal liability cover automatically included.

9. Santam

As South Africa's largest short-term insurer, Santam boasts a legacy of reliability and trust. Their flexible home insurance policies cater to specific risks, offering protection against burglary, power surges and accidental damage. With a vast network of intermediaries and 24/7 emergency assistance, Santam provides personalised service and comprehensive coverage to homeowners.

As South Africa's largest short-term insurer, Santam boasts a legacy of reliability and trust. Their flexible home insurance policies cater to specific risks, offering protection against burglary, power surges and accidental damage. With a vast network of intermediaries and 24/7 emergency assistance, Santam provides personalised service and comprehensive coverage to homeowners.

Santam provides homeowners with all the home insurance they need, including:

-

Building insurance: Protect your property against unexpected fire, explosion, flood, lightning, burglary and theft, plus fixtures and fittings on your property.

-

Home contents insurance: Insure your household contents for their replacement value, covering for loss or damage in the event of a fire, explosion, storm, flood, lightning, burglary or theft.

-

All-risk insurance: Cover the items that are important to you outside of your home, including jewellery, mobile devices, eyewear, laptops, computer equipment, cameras, sports gear, bicycles and more.

With each insurance option, homeowners can choose between 3 different plans, depending on their needs and budget, namely the core, classic and executive plans.

10. King Price Insurance

King Price Insurance stands out for its advanced pricing model, offering decreasing premiums as the value of insured items depreciates. This unique approach ensures affordability and transparency for homeowners. With comprehensive cover and exceptional customer service, King Price Insurance offers peace of mind to homeowners facing various risks.

King Price Insurance stands out for its advanced pricing model, offering decreasing premiums as the value of insured items depreciates. This unique approach ensures affordability and transparency for homeowners. With comprehensive cover and exceptional customer service, King Price Insurance offers peace of mind to homeowners facing various risks.

Let’s take a look at King Price’s insurance options for homeowners:

-

Building insurance: Covers damages to the physical structures on your property, such as your home and its outbuildings, including loss of, or damage to, your buildings, geysers and water pipes as well as accidental damage to fixed glass and sanitary ware, water, gas, electricity and phone connections.

-

Home contents insurance: Covers the loss of, or damage to items in your home, which belong to you and the people who live with you, excluding tenants and except if this loss or damage is the result of theft or attempted theft.

-

Portable possessions insurance: Covers the repair or replacement of possessions, like clothing and cameras, tablets, travel luggage and jewellery, if they're stolen or damaged while they're anywhere other than in your home.

Conclusion

There you have it! Everything you need to know about the most reputable home insurance companies in South Africa. Home insurance provides financial security in times of crisis, ensuring that your cherished home remains safe and secure. From stability and flexibility to affordability and innovation, these top insurers offer tailored solutions to meet your needs.

So, take the proactive step today and secure your home with one of these reputable insurance providers. Because when it comes to protecting your home, there's no room for compromise.

What do our customers say?

What’s happening?

Please notify us of any violations. This information will be kept confidential and shared only with Wise Move.

- It’s inaccurate or incorrect

- If you find it offensive

- It’s something else